As an investor There’s always a point of discussion like in which stock I’ve to invest in for more return, It’s more serious when you are a working professional with an average salary of 50,000 INR or maybe below.

Let’s understand from where we can start investing but let me guess after reading an energy stock first name that comes to your mind surely Adani Green, NTPC, Tata Power, or Power Grid.

But The fact is if you understand the title then you have to understand a few things i.e. India’s Growth % in Energy produced, Which sector produced more, Growth of individual sectors.

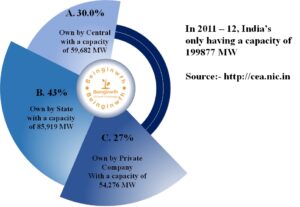

Let’s understand, Energy Produced capacity by India in 2012 any guess

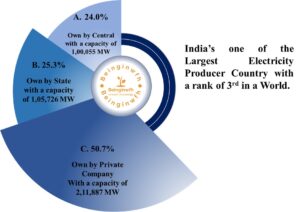

Currently, India’s one of the 3rd highest Energy produced in a Globe with a capacity of 4,17,668 MW “Mega Watt”. As quickly as you understand by comparing those 2 graph, You might take your decision i.e. Only Private growing now a day but the point of discussion at what rate?

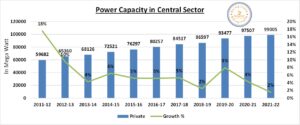

If We were talking about first with Private, State & Central Sector so let’s see

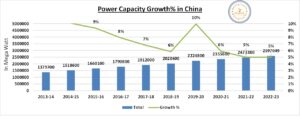

Let me guess, After understand those graph you come again the conclusion i.e. average growth in Energy Sector is 2 – 8% or an average 5%. So that’s not a correct time invest in Energy Stock but wait let’s see global figure or better to say another 1st & 2nd position country i.e. China & USA.

Now, You can make your final discussion depends on your type of investment whether you’re defensive investor or Growth.

Survey is very authentic. It help many of people who deals in stock market.

Very well summarized

The way investors perspective presented here is really insightful for all people who are upfront to dive in Energy sector. We all will be waiting for your next Blog.